Let’s start:- Recent stock market crashes reading answers

Let’s start:- Recent stock market crashes reading answers

READING PASSAGE 2

You should spend about 20 minutes on Questions 14-27 which are based on Reading Passage 2 below.

Recent stock-market crashes

For as long as there have been financial markets, there have been financial crises. Most economists agree, however, that from 1994 to 2013 crashes were deeper and the resultant troughs longer-lasting than in the 20-year period leading up to 1994. Two notable crashes, the Nifty Fifty in the mid-l 970s and Black Monday in 1987, had an average loss of about 40% of the value of global stocks, and recovery took 240 days each, whereas the Dot-com and credit crises, post-1994, had an average loss of about 52%, and endured for 430 days. What economists do not agree upon is why recent crises have been so severe or how to prevent their recurrence.

John Coates, from the University of Cambridge in the UK and a former trader for Goldman Sachs and Deutsche Bank, believes three separate but related phenomena explain the severity. The first is dangerous but predictable risk-taking on the part of traders. The second is a lack of any risk-taking when markets become too volatile. (Coates does not advocate risk-aversion since risk-taking may jumpstart a depressed market.) The last is a new policy of transparency by the US Federal Reserve – known as the Fed – that may have encouraged stock-exchange complacency, compounding the dangerous risk-taking.

Many people imagine a trader to have a great head for maths and a stomach for the rollercoaster ride of the market, but Coates downplays arithmetic skills, and doubts traders are made of such stern stuff. Instead, he draws attention to the physiological nature of their decisions. Admittedly, there are women in the industry, but traders are overwhelmingly male, and testosterone appears to affect their choices.

Another common view is that traders are greedy as well as thrill-seeking. Coates has not researched financial incentive, but blood samples taken from London traders who engaged in simulated risk-taking exercises for him in 2013 confirmed the prevalence of testosterone, cortisol, and dopamine – a neurotransmitter precursor to adrenalin associated with raised blood pressure and sudden pleasure.

Certainly anyone faced with danger has a stress response involving the body’s preparation for impending movement – for what is sometimes called ‘Fight or flight’, but, as Coates notes, any physical act at all produces a stress response: even a reader’s eye movement along words in this line requires cortisol and adrenalin. Neuroscientists now see the brain not as a computer that acts neutrally, involved in a process of pure thought, but as a mechanism to plan and carry out a movement, since every single piece of information humans absorb has an attendant pattern of physical arousal.

For muscles to work, fuel is needed, so cortisol and adrenalin employ glucose from other muscles and the liver. To burn the fuel, oxygen is required, so slightly deeper or faster breathing occurs. To deliver fuel and oxygen to the body, the heart pumps a little harder and blood pressure rises. Thus, the stress response is a normal part of life, as well as a resource in fighting or fleeing. Indeed, it is a highly pleasurable experience in watching an action movie, making love or pulling off a multi-million-dollar stock-market deal.

Cortisol production also increases during exposure to uncertainty. For example, people who live next to a train line adjust to the noise of passing trains, but visitors to their home are disturbed. The phenomenon is equally well-known of anticipation being worse than an event itself: sitting in the waiting room thinking about a procedure may be more distressing than occupying the dentist’s chair and having one. Interestingly, if a patient does not know approximately when he or she will be called for that procedure, cortisol levels are the most elevated of all. This appeared to happen with the London traders participating in some of Coates’ gambling scenarios.

When there is too much volatility in the stock market, Coates suspects adrenaline levels decrease while cortisol levels increase, explaining why traders take fewer risks at that time. In fact, typically traders freeze, becoming almost incapable of buying or selling anything but the safest bonds. In Coates’ opinion, the market needs investment as it falls and at rock bottom – at such times, greed is good.

The third matter – the behaviour of the Fed – Coates thinks could be controlled, albeit counterintuitively. Since 1994, the US Federal Reserve has adopted a policy called Forward Guidance. Under this, the public is informed at regular intervals of the Fed’s plans for short-term interest rates. Recently, rates have been raised by small but predictable increments. By contrast, in the past, the machinations of the Fed were largely secret, and its interest rates fluctuated apparently randomly. Coates hypothesises these meant traders were on guard and less likely to indulge in wild speculation. In introducing Forward Guidance, the Fed hoped to lower stock and housing prices; instead, before the crash of 2008, the market surged from further risk-taking, like an unleashed pit bull terrier.

There are many economists who disagree with Coates, but he has provided some physiological evidence for both traders’ recklessness and immobilisation and made the radical proposal of greater opacity at the Fed. Although, as others have noted, we could just let more women onto the floor.

Questions 14-19

Choose the correct letter A, B, C, or D.

Write the correct letter in boxes 14-19 on your answer sheet.

14 What do most economists agree about the financial crashes from 1994 to 2013?

A They were the worst global markets had ever experienced.

B Global stocks fell around 40% for a period of 240 days.

C They were particularly acute in the US.

D They were more severe than those between 1974 and 1993.

15 What does John Coates think about risk-taking among stock-market traders?

A It is almost invariably dangerous.

B It was prevalent at Goldman Sachs and Deutsche Bank.

C It should be regulated by the US Federal Reserve.

D It can sometimes assist a weak market.

16 What is some popular belief about traders?

A They are clever, calm, and acquisitive.

B They are usually men who are good at maths.

C They love danger and seek it out.

D They do not deserve their high salaries.

17 What did Coates find in blood samples from London traders in 2013?

A They had high levels of testosterone and dopamine.

B They produced excessive glucose and oxygen.

C They experienced high blood pressure.

D They drank large amounts of alcohol.

18 How do neuroscientists now view the brain?

A As an extraordinary computer.

B As an organ to control movement.

C As the main producer of adrenaline and cortisol.

D As a significant enhancer of pleasure.

19 Why might a person wait to see a dentist have extremely high cortisol levels?

A He or she may dislike going to the dentist.

B He or she may be worried about the procedure.

C He or she may not have a specific appointment.

D He or she may not be able to afford the consultation.

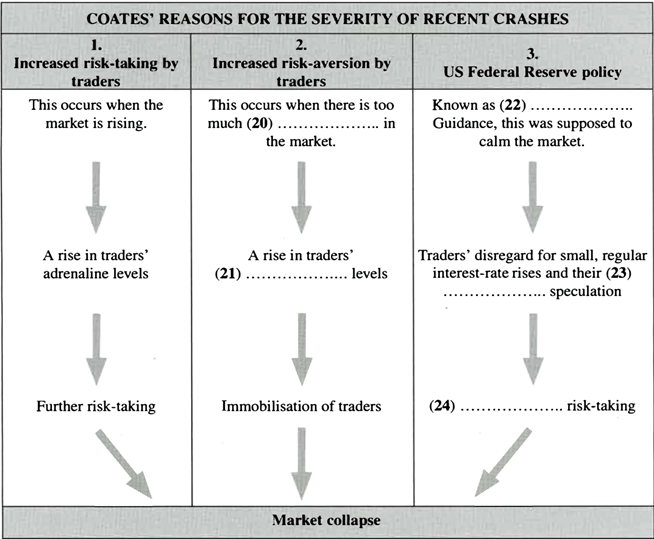

Questions 20-24

Complete the flowchart below.

Choose ONE WORD ONLY from the passage for each answer

Write your answers in boxes 20-24 on your answer sheet.

Questions 25-27

Do the following statements agree with the claims of the writer in Passage 2?

In boxes 25-27 on your answer sheet, write:

YES if the statement agrees with the claims of the writer.

NO if the statement contradicts the claims of the writer.

NOT GIVEN if it is impossible to say what the writer thinks about this.

25 Coates’ views are held by many other economists.

26 Coates’ suggestion of less transparency at the Fed is sound.

27 Raising the number of female traders may solve the problem.

Answers:- Recent stock market crashes reading answers

Passage 2

14. D

15. D

16. C

17. A

18. B

19. C

20. volatility

21. cortisol

22. Forward

23. wild

24. Further

25. NO

26. NOT GIVEN

27. YES

If you enjoyed “Recent stock market crashes reading answers”, please share this post and comment on it.

Regards

Er. Nachhattar Singh ( CEO, blogger, youtuber, Motivational speaker)